Legal Responsibility Automobile Insurance Coverage Coverage

Table of Content

Your car insurance company won't allow legal responsibility limits high sufficient to cowl all of your belongings — many auto insurers have a most bodily damage restrict of $500,000 or decrease. This desk exhibits the common prices for full-coverage automotive insurance coverage policies for 35-year-old female and male drivers in New Orleans. However, USAA insurance is just available to army members, veterans and their immediate family. Liability insurance covers property harm and accidents you by accident trigger to others. If the other driver triggered the car accident, you can make a declare on their insurance on your automobile harm. While liability is required in most states, collision and complete automotive insurance is optional.

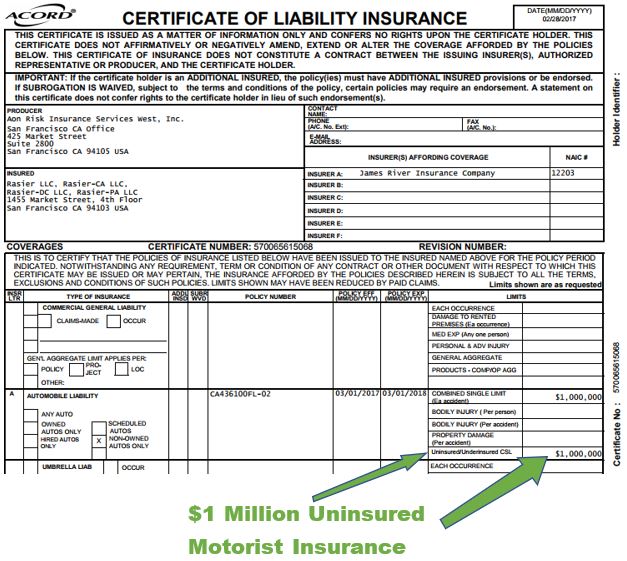

Commercial auto liability insurance protects you and your staff on the highway if you’re driving for enterprise. The quantity of auto liability coverage you want can range by state. Your industrial auto coverage will doubtless embrace the minimum coverage for bodily damage liability and property harm coverage.

What's Legal Responsibility Automotive Insurance?

Collision and complete insurance coverage protects their interest in case the car is totaled or stolen. Dropping collision and comprehensive coverage from a financed or leased car could void the terms of your mortgage or lease. In Virginia, a driver can decline legal responsibility insurance by paying an annual payment of $500 to the state. But should you cause a car crash, you will still be held answerable for property harm and bodily injuries, meaning you would have to pay out-of-pocket for medical bills and property injury. A basic legal responsibility coverage is a complete policy that covers a variety of liabilities, but there are limits to what general legal responsibility does and doesn't cover. For instance, general liability insurance policies usually exclude claims for negligence and accidents caused by the actions of your employees.

The right time to discontinue full protection will differ relying in your monetary state of affairs and danger tolerance. However, drivers ought to think about opting out of complete and collision coverage when the value of their automotive falls between 4 and six occasions the annual cost of coverage. Collision and complete insurance coverage pays for damages to your car up to its cash worth. When you file a comprehensive or collision declare, you’ll be liable for covering your deductible, which may vary from $250 to $1,000. Full protection doesn’t imply the coverage has all of the bells and whistles. This time period refers to policies that embody liability protection along with collision and comprehensive insurance coverage.

Split Restrict Legal Responsibility

This may include accidents to other drivers and their passengers, and damage to other vehicles or civic property. Liability automotive insurance coverage doesn’t pay for your own expenses, corresponding to medical treatment or automobile repairs. The common cost of automobile insurance in New Orleans is much larger than the nationwide common even when you’re an excellent driver with a clean record. The least expensive automobile insurance corporations in New Orleans are typically Southern Farm Bureau, USAA, Geico, State Farm and Progressive. If you finance or lease a automotive, your lender or leasing company will more than likely require you to have full protection automobile insurance coverage.

Bodily Injury Liability Insurance helps cowl somebody else’s medical bills that end result from an injury or accident. Geico coverage and providers can be found in all 50 states and the District of Columbia and there are 16 several types of discounts available. In addition to the usual coverage options, Geico offers various elective add-ons, such as emergency roadside assistance, rental automotive reimbursement and mechanical breakdown insurance coverage. We’re going to make issues as simple as possible here and now, so you will get the best legal responsibility auto insurance coverage for you, on the most affordable rate.

Liability car insurance is often divided into a property liability portion and an injury portion. Let’s look into the standard coverages with liability auto insurance coverage. However, you might feel financial pain later in the form of a surcharge. Auto insurance corporations will usually increase your charges at renewal time if you’ve brought on an accident. With so many choices for automobile insurance coverage firms, it may be hard to know where to begin to find the best automotive insurance. We've evaluated insurers to search out one of the best automobile insurance coverage companies, so you don't have to.

For occasion, if a tree falls in your automotive, or it’s broken by hail, otherwise you hit a deer, you possibly can file a comprehensive claim. 25 represents $25,000 of bodily injury legal responsibility for one person per accident. There are several issues you must understand when contemplating professional and basic legal responsibility insurance coverage.

If you wouldn't have sufficient car liability insurance coverage, your belongings could be at risk if you cause a automobile accident that ends in substantial damage or accidents. This pays for automotive repair payments should you get right into a car accident, irrespective of who's at fault for the accident. Collision insurance coverage is an optionally available coverage type, meaning you’ll have to pay extra to add it to your policy. Most states require a minimal level of liability coverage, however it’s usually not enough to correctly protect you if you’re in a crash. Property injury legal responsibility safety applies to damages to property ensuing from a coated accident by which you’re at fault.

If you live in a state that doesn't require auto insurance coverage, similar to New Hampshire or Virginia, you are still answerable for accidents and property harm attributable to an accident. Comprehensive coverage contains your state’s legal responsibility protection and comprehensive and collision protection. This is normally solely needed in case you are leasing or financing your automobile. Of course you wish to run your corporation perfectly, but accidents can occur. If your client is injured and loses money, they will sue your business. Liability Insurance covers property harm or accidents from an accident the place you or your small business are at fault.

So, it’s impossible to give you the precise cost of your liability insurance however we are able to communicate in generalities. While legal responsibility insurance coverage does not cowl damages to you or your car, it does cover damages to different individuals and their property. You’ll most probably be required to have each collision and comprehensive insurance coverage if you have a automobile loan or lease. Bodily injury legal responsibility safety applies to the medical bills of the other get together if you are found at fault within the accident. In some circumstances, it might even cowl misplaced wages and/or legal fees if the injured celebration files a lawsuit.

Bodily harm is paid on a per-person and per-incident basis, with two limits. The first restrict is how a lot the insurance coverage company will pay for any one particular person injured in an accident. The second restrict is how much it'll pay for everybody injured in an accident. Unlike legal responsibility coverage, it doesn't lengthen to bills for another’s particular person broken automobile. Liability covers restore prices for another person’s automobile, together with medical prices together with prescriptions, medical care or misplaced wages as a result of an accident. Cheap automotive insurance in Louisiana, however they’ll probably pay decrease charges than single drivers with related profiles.

Liability insurance doesn't cover damage to your personal car or personal injury, solely damage to others for which you might be legally responsible. The info contained on this web page shouldn't be construed as specific legal, HR, monetary, or insurance coverage advice and is not a assure of protection. In the event of a loss or claim, coverage determinations will be topic to the coverage language, and any potential declare cost shall be determined following a declare investigation.

You can sometimes purchase $1 million in protection for around $150 to $300 per yr, in accordance with the Insurance Information Institute. Drivers in Virginia can pay a $500 uninsured motorcar payment to skip car insurance. But when you trigger an accident, you’ll nonetheless be personally answerable for accidents and property injury, that means you could be caught paying for accidents and property harm. While a great automobile insurance coverage is made up of a number of kinds of coverage, legal responsibility automobile insurance coverage is the muse. It’s required in most states and is often the costliest portion of a policy. Auto liability insurance coverage helps cowl the costs of the opposite driver’s property and bodily injuries if you’re discovered at fault in an accident.

Car Insurance Explained

Therefore, it is typically really helpful that every one businesses have basic legal responsibility coverage. As your automotive ages, collision and comprehensive protection will worsen. This is as a outcome of the value of a automobile depreciates sooner over time than the cost of complete and collision coverage.

Comments

Post a Comment