Colorado First-Time Home Buyer Programs

Table of Content

All the properties displayed on this website are generated automatically from the Carolina MLS and are updated daily. The Good Neighbor Next Door program is a first-time home buyer program sponsored by HUD. With this program, police officers, teachers, firefighters and emergency technicians can purchase a qualifying HUD property for 50% of the listed price. At Cornerstone Realty Carolinas, one of our areas of specialization is first time home buyers. We have assisted hundreds of first time home buyers with their real estate needs in the Charlotte region.

This article contains information obtained from third-party sources and is for informational purposes only and is not intended to be relied upon as financial advice, guarantees or warranties of any kind. Nor is it an endorsement of any third-party organization or service. The Florida Assist ($7,500, 0 percent deferred second mortgage). Eligibility restrictions apply; the less you put down, the higher the VA funding fee will be. But, assuming the IRA has been open for at least five years and you don’t take out more than $10,000 worth of earnings, the withdrawal should be tax- and penalty-free.

Mortgage Credit Certificate Tax Credit Program

The buyer selects their own eligible property to purchase and meets with one of the participating lenders to pre-qualified for a mortgage loan. Designed for borrowers with a credit score of 620 or higher, the SmartStep mortgage program offers CHFA’s lowest mortgage interest rates. You can combine SmartStep with a Mortgage Credit Certificate and down payment assistance for added savings. The CHFA SmartStep program provides down payment assistance for FHA, FHA 203, VA and USDA Rural Development loans. The CHFA FirstStep program CHFA provides access to 30-year, fixed-rate mortgages. Homebuyers don’t need to have a credit score to qualify, but if you do have a credit score, it must be at least 620.

Although conventional loans include basic eligibility guidelines, your lender might have stricter requirements, such as minimum down payments and debt-to-income ratios. The program allows 100% financing for home buyers with 580 credit scores or higher and modest income. USDA mortgage rates are often the lowest of all the low-down payment mortgage loans. State and local governments sometimes provide cash grants to qualified first-time buyers.

✳️ CHFA Mortgage Credit Certificate

The only downside is that all adult residents need to meet these requirements. NADLs don’t require high credit score minimums or the purchase of private mortgage insurance, which is a perk that extends from normal VA loans. To make things even better, NADLs come with significantly lower closing costs. To open a first-time home buyer savings account, an account holder merely needs to create a new account with a financial institution authorized to do business in Michigan.

That does require 10% down; if you want the minimum 3.5% down, your credit will need to be at least 580. There are Conventional loan down payment mortgage options for as low as 620 with 3% down. The biggest differences at the lower scores are the costs involved between higher interest rates and mortgage insurance.

State and local programs

Combining various datasets, we have plotted estimates of the proportion of first-time homebuyers over time and how many there were in each year since 2000. In 2020, there were an estimated 1,782,500 first-time home buyers. You will be required to complete an approved home buyer education course before closing on your home.

We are not liable for any errors or content of blogs or for any losses, injuries or damages arising from its display or use. There is no obligation to update information provided in a blog on this site. With the myriad of difference and possibilities, the best way to truly figure out the best option for you is to consult a Mortgage Loan Originator.

For example, if you have a $300,000 mortgage, that means $12,000 toward initial homeownership costs. In 1938, the federal government created a public mortgage lender, known colloquially as Fannie Mae. In 1970, the government launched another, known as Freddie Mac. Each lender has a selection of loans for first-time homebuyers.

2017 figures show the lowest proportion of first-time buyers in the market at 29%, however, the year also saw the highest number of overall home buyers since 2006 . For example, the overall homeownership rate for white households in 2019 was 73.1%, but 46.6% for Hispanic households, and 40.6% for Black households. Reporting on 2020 data, 82% of homebuyers aged were first-time buyers. This contrasts with 48% of buyers aged 31-40, and 22% of those aged 40-54.

This is one of the most popular first-time home buyer programs for people with lower credit scores and one of the easiest mortgages to qualify for. If you have a credit score of 580 or higher, the FHA will allow down payments as low as 3.5%. If your credit score falls between 500 and 580, you will need to make a 10% down payment. Mortgage insurance is required for the life of an FHA loan and cannot be canceled. Many first-time home buyers are eligible for cash assistance offered by state and local governments. These down payment assistance programs can help you buy a house if you can’t afford the down payment out of pocket.

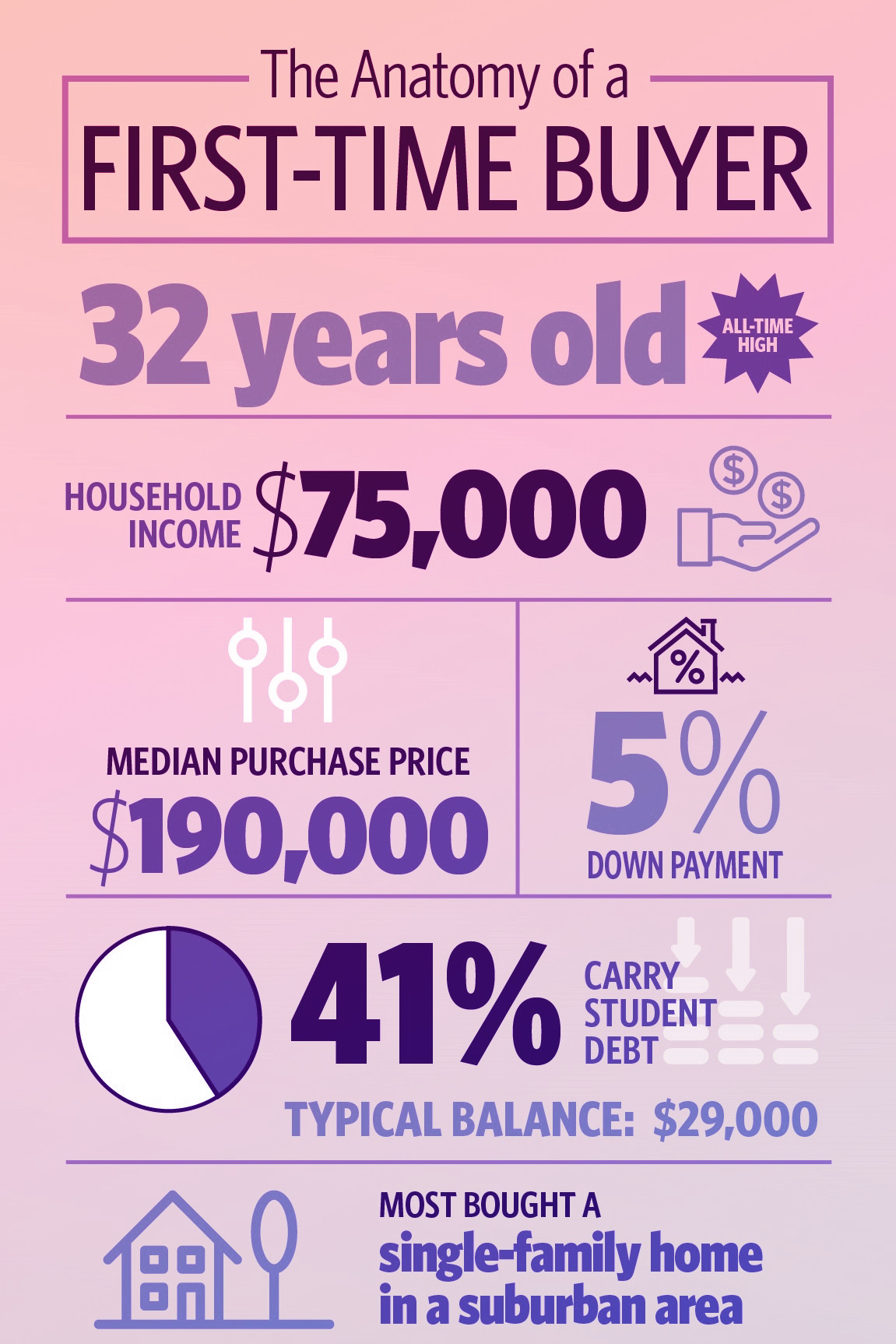

But what is the exact makeup of the typical first-time homebuyer? The following is a breakdown of the average demographics for first-time homebuyers in the U.S. The average first-time homebuyer down payment across all states is $8,220, which is 6% of the average first-time home price of $137,008. The average first-time homebuyer is 33 years old, while Black first-time homebuyers are on average 39 years old. Buying a first home is typically the largest financial decision and commitment most people will ever make. We wanted to find out just how big this impact was on the nation, and what the first-time buyer market looks like.

This comes from the same down payment analysis that worked out the average first-time buyer demographic and calculated the salary using statistics from the Bureau for Labor Statistics. Separately, 28% of all homebuyers aged lived with their parents before moving into their first property. Importantly, this data point data does not distinguish this group as definitively first-time buyers. However, they are within the expected age for first-time homeownership and therefore can represent the group of home-buyers. The average credit score for a first-time homebuyer is 725, repeat buyers have an average score of 770.

However, you should expect to pay for private mortgage insurance . However, you should expect to pay private mortgage insurance for the duration of the FHA loan if your LTV ratio is less than 90 percent at the time of closing. If you are buying your first home, you can apply for a mortgage interest tax credit known as a Mortgage Credit Certificate . To qualify, you must meet certain income requirements and the home must meet certain sales price restrictions.

Comments

Post a Comment